Closing Revenue Accounts Journal Entry

Ad Excel close management checklist by accountants for accountants. This problem has been solved.

Closing Entries Definition Types And Examples

Closing Directly to Equity.

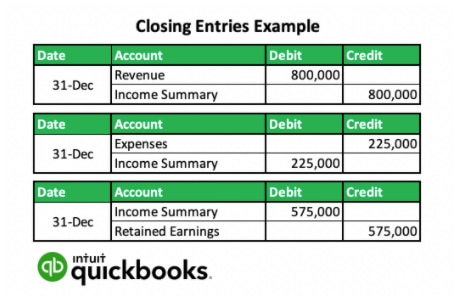

. A closing entry is a journal entry made at the end of the accounting period in which data is moved into the permanent accounts on the balance sheet from. Close Revenue accounts Close means to make the balance zero. Here are the steps to creating closing entries.

Steps in the Accounting Cycle. Ad Excel close management checklist by accountants for accountants. This section of the balance sheet is a crucial.

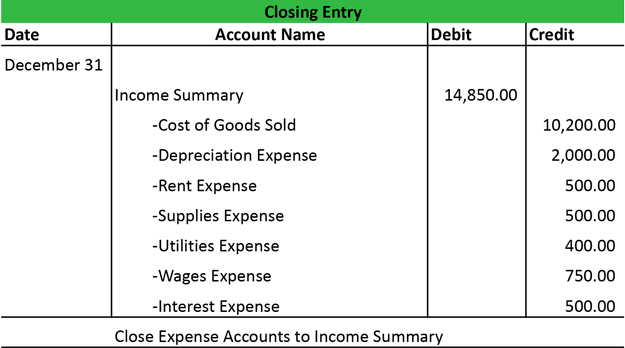

Close your books faster. Prepare the entry to close the expense account s. Likewise the income summary journal entry is necessary as the company needs to transfer all the revenues and expenses accounts to the income summary account before it can close the net.

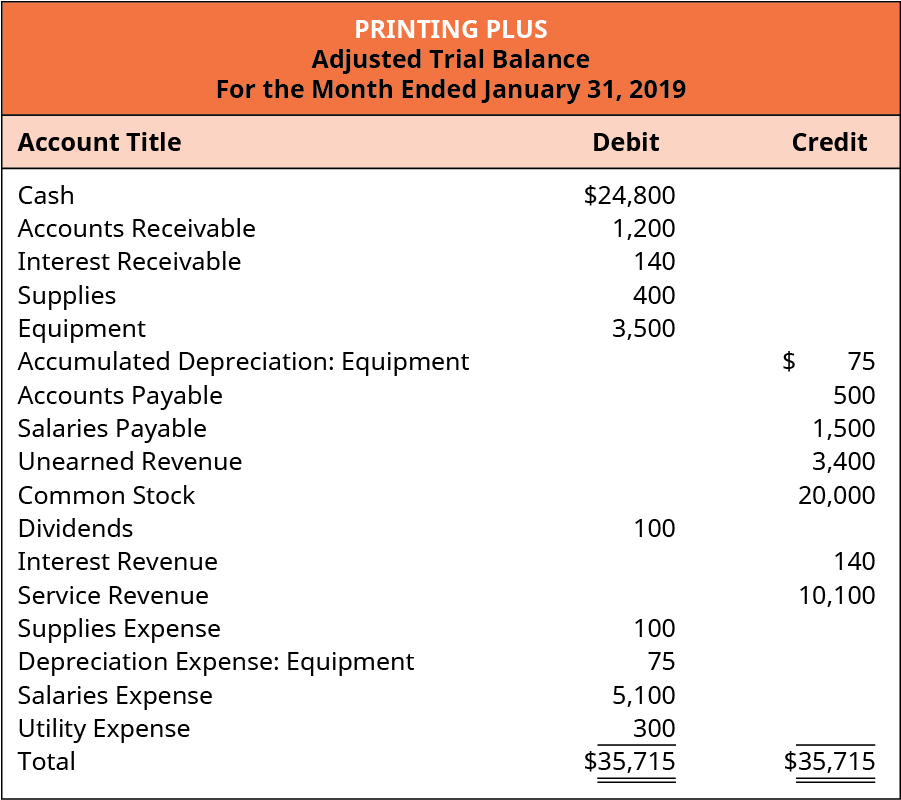

Your closing journal entries serve as a way to zero out temporary accounts such as revenue and expenses. How do you close revenue accounts to retained earnings. We see from the adjusted trial balance that our revenue accounts have a credit balance.

When closing the revenue. Debits each revenue account. 8 To return to the previous example if you had 36500 in Service Revenue.

Close revenue accounts For end journal entries companies first summarize the revenue account in the general ledger. Zero out the temporary revenue accounts to close them moving the balance to Income Summary. It records funds at the end of an accounting period.

Step one is to cancel all revenue accounts. Close revenue accounts by transferring funds to income summary account. The closing process reduces revenue expense and dividends account balances temporary accounts to zero so they are ready to receive data for the next accounting period.

Closing entries are journal entries used to empty temporary accounts at the end of a reporting period and transfer their balances into permanent accounts. How to optimize your close process structure your checklist keep working in Excel. We must complete the closing entries in order to ensure that they are consistent and that the temporary accounts are zeroed out.

Closing the revenue accounts are therefore mean transferring its credit balance to the Income Summary account. In some cases companies may have various revenue accounts. Closing Income Summary Create a new journal entry.

How to optimize your close process structure your checklist keep working in Excel. Prepare the entry to close the revenue account s. Post Journal Entries to General Ledger.

A closing entry is a journal entry that an accountant makes on a balance sheet. Closing entries also called closing journal entries are entries made at the end of an accounting period to zero out all temporary accounts and transfer their balances to permanent accounts. This transfer is accomplished by a journal entry debiting the revenue.

Close your books faster. Select the Income Summary account and debitcredit it. To make them zero we.

A temporary account used in closing revenue and expense accounts. When using the direct-to-equity method of closing entries one closing journal entry is done that. Closing the revenue account.

How To Create Opening And Closing Entries In Accounting Quickbooks Canada

Closing Entries Types Example My Accounting Course

1 15 Closing Entries Financial And Managerial Accounting

Closing Revenue Expense And Dividend Accounts Principlesofaccounting Com

Comments

Post a Comment